- November ABS data shows value in new loan commitments reached a record high

- Loan commitments for existing dwellings were the largest contributor to the November rise

- REIA President says the data confirms the resilience of the housing market

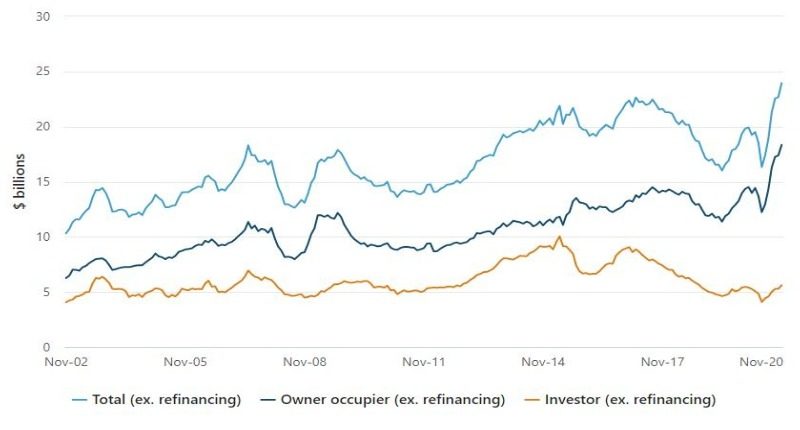

The latest statistics for borrower-accepted finance commitments for housing loans released by the Australia Bureau of Statistics (ABS) shows the value of new loan commitments for housing grew and reached a record high.

The seasonally adjusted value of new loan commitments for owner occupier housing rose 5.6% to $24 billion in November 2020, a 23.7% increase on last year.

Loan commitments for existing dwellings were the largest contributor to the rise in owner occupier housing loan commitments, increasing 5.9% with construction loan commitments up 5.6%.

The number of owner occupier first home buyer loan commitments rose 3.1%, a 42.5% rise since the start of the year.

There was a surge in housing market activity following the easing of COVID-19 restrictions in Victoria, the figures showing loan commitments for the state rose sharply by 19.6%.

The total value of loan commitments for investor housing rose 6% to reach $5.6 billion.

Federal and state government incentives, such as the HomeBuilder grant (implemented in June 2020), in addition to low interest rates (a historic low cash rate of 0.1%) set by the Reserve Bank of Australia have contributed to the continuing growth in new housing loan commitments.

With investors, first home buyers, and owner occupiers all active in the market, REIA President, Adrian Kelly said the November leading figures confirm the resilience of the housing market.

“With limited stock and strong demand driven by a record low interest rate outlook, the market is likely to remain buoyant for the coming 12 months defying the doomsday forecasts of last year.”