- NAB Residential Property Index ends 2020 on a high note

- Market sentiment has improved across all states

- Expectations for house prices have also improved from the previous quarter

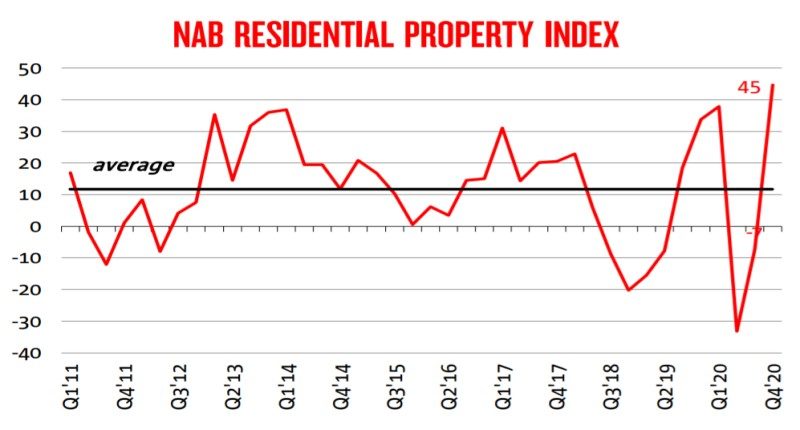

Despite recent economic hardship, the NAB Residential Property Index ended 2020 at a survey high of +45 points in Q4, after having fallen to a survey low of -33 points in Q2.

Record low-interest rates (discussed here) and household income support from the Federal Government have been key drivers for dwelling price growth, with NAB increasing their forecast to around 8% in 2021 and a further solid rise of 6% in 2022.

It is expected that price growth in the smaller capitals will outpace Sydney and Melbourne, which will likely be impacted most by a slowing in population growth.

When breaking down the results by state, NAB found housing market sentiment has improved across all states (see table below).

Dwelling prices in Darwin outpaced all capital cities according to CoreLogic data, while WA’s state index rose to a new survey high of +79.

Meanwhile, Victoria managed to climb back into positive territory (+6) after suffering the strictest lockdowns in the country, albeit remains the weakest of all states and territories.

Sentiment in the ACT, SA and QLD exceeded the national average, with SA recording the strongest result since the survey began (+69).

The report shows housing prices have held up much better than expected, despite a weak labour market and elevated uncertainty over the pace of population growth.

With borrowing rates at record lows (caused by substantial easing in monetary policy), in addition to large support from the government in the form of JobKeeper and JobSeeker payments, the predicted negative impact on households appear to have largely been mitigated.

This is evident in survey expectations for house prices in Q4 2020 (see table below), with respondents expecting to see national house prices rise 3.1% over the next year (up from the previous Q3 expectation of -0.6%).

Overall, NAB sees house price growth at around 10% by 2022.

~~

The survey results also discuss rental expectations, new developments, new housing market constraints, and foreign buyers. To read the full report: NAB Residential Property Survey Q4-2020 (available online).

Before investing in any asset, please do your own independent research, taking into account your own personal financial situation. This article does not purport to provide financial advice. See our Terms of Use.