- There has been a huge demand in properties valued at under $600K

- The property in the short-term is used as accommodation for young adult chidlren

- Longer term it is used like any other investment property - for longer term growth

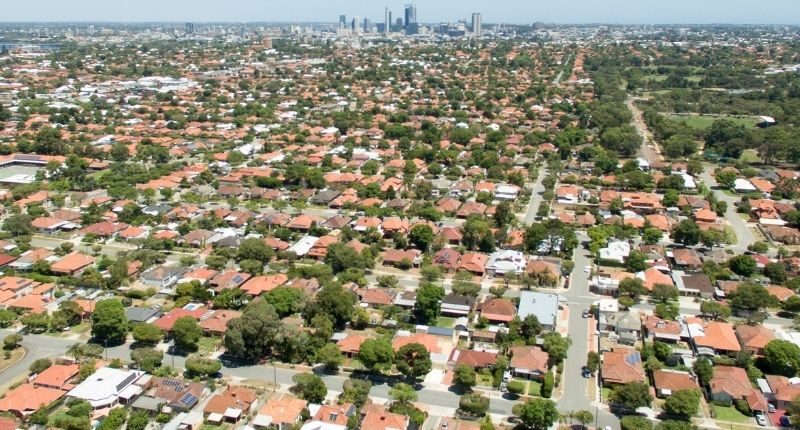

Over the past six months, there has been an unprecedented push for properties valued at under $600,000 – just above the Perth median of over $550,000 – from baby boomer parents wishing to purchase property out of concerns for their children.

This is a rapidly developing trend that is now seeing a good portion of purchases being dual purpose.

For example, the property is an initial investment with all the usual benefits of negative gearing and depreciation, and more importantly long-term capital growth.

In the short term, however, the same property is adequately serving a second and more immediate role as a place for the parent’s children to reside safe from the spiralling rental market.

Alternately parents are offering the capital tied up in their family homes to unleash some equity to assist their children. This style of lending is called “Parents Assist” and is becoming more popular, especially in the current rental crisis we are experiencing.

Apartments are predominately favoured by the children of the baby boomers, as the children can continue their university studies or similar in the close confines of the entertainment precinct, and public transport, knowing that they are safe from steady rental increases that won’t hamper them in their pursuits for the next few years.

Obviously, the parents are prepared to subsidise the rent to some degree because of all the other benefits offered by investment.

Traditionally, the parents ensure this is an arms-length transaction by validating the child’s lease to the standard rental management process.

The particular demand for properties of this nature has extended dramatically in the last six months, mainly within five kilometres of the inner city, and this is likely to increase.