- PIPA analysis shows historical price increases alongside cash rate rises

- Ease of credit access major factor in price surge post-pandemic, not low rates

- Growing borrower fears due to alarmist commentary remain baseless

The current cash rate set by the Reserve Bank of Australia (RBA) sits at 0.10%, a historic low the RBA says is unlikely to change for several years.

Despite the RBA’s reassurance, many fear the property market will burst once interest rates increase, though analysis by the Property Investment Professionals of Australia (PIPA) says this won’t be the case.

The PIPA analysis indicates that interest rates are not the sole driver of property booms or busts, and points to affordability, local economic conditions, consumer sentiment, and access to lending as contributing factors.

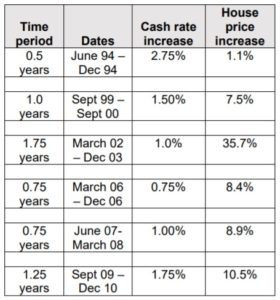

PIPA analysed five periods of cash rate increases since 1994, finding that house prices continued to increase despite the cash rate increases.

Cash Rate Rises and House Price Movements

Access to credit a major factor in price surge

PIPA Chairman Peter Koulizos said the condition of the property market is typically most reliant on local economic conditions, and is never exclusively impacted by rate adjustments.

“There has been much conjecture over the past 18 months that record low interest rates are the singular reason why property prices have skyrocketed, when the cash rate was already at a former record low of 0.75 per cent before the pandemic hit.”

Peter Koulizos, PIPA Chairman

Mr Koulizos added that many factors are impacting soaring prices including buyer hysteria, but the increase in ease of access to credit is a major factor that was much weaker prior to the pandemic.

“At the end of the day, even when interest rates are low as they have been for years

now, if people don’t have access to finance, it really doesn’t matter what the cash

rate is,” he added.

Unfounded fears of bubble burst

Mr Koulizos said the misconception that rising interest rates will result in a sharp price decline is being spread by alarmist commentary.

He added that borrowers are fearing not being able to afford their mortgage due to scaremongers circulating stories of extreme mortgage debt.

“The latest ABS Lending Indicators showed that the national average loan size for

owner-occupier dwellings was $574,000 in September, which shows that the vast

majority of people are not racking up massive singular mortgages of $1 million or

more,” Mr Koulizos said.

These fears are unfounded, as according to Mr Koulizos interest rates are not expected to rise for a year or so and are unlikely to see rapid growth.

“It’s vital to understand that new loans are already been stress-tested against much higher interest rates of about 5.65 per cent, so there is little to be gained by alarmist ‘forecasts’ that are just not supported by the data.”

Peter Koulizos, PIPA Chairman