- SQM Research reveals national residential vacancy rate decreased by 0.2% over January.

- Total number of vacancies is now 71,297 residential properties, or 2.0%.

- Melbourne and Sydney recorded decreases in vacancy rates, but still remain high relative to other cities.

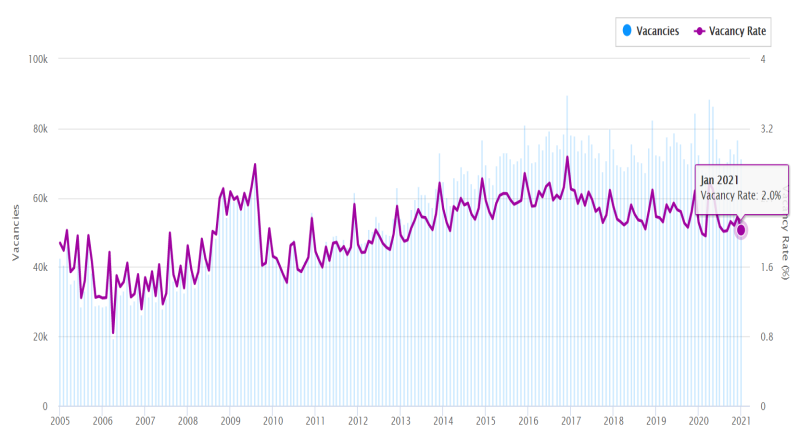

SQM Research has revealed the national residential vacancy rate decreased by 0.2% over the month of January 2021.

The total number of vacancies now stands at 71,297 vacant residential properties, or 2.0%. This compares to January last year where the national vacancy rate was higher at 2.2%. It must be noted however that there are now fewer vacancies at the national level compared to January 2020 (just prior to the first outbreak of COVID-19 in Australia).

As shown in the table below, almost all capital cities recorded falls in vacancies for the first month of 2021 compared to December 2020 (the exception being Hobart which remained unchanged at 0.6%).

Sydney recorded a fall in vacancies over the month from 3.6% to 3.2%. Again, CBD rental market vacancy rates plummeted to 6.2% after being as high as 16% in May 2020. The city also recorded the highest increase in Capital City average asking rents – 3.2% for houses and 2.2% for units over the period of 30 days to 12 February (the first significant rise since February 2020).

Melbourne’s vacancy rate still remains the highest for any of the capital cities, despite decreasing in the month from 4.7% to 4.4%. The city recorded declines in both house and unit asking rents over the month, falling by 0.1% and 0.4% respectively.

Managing Director of SQM Research, Louis Christopher said the research house remains with the view that there will not be a complete reversal of the sharp rise in rental vacancy rates experienced in the two major cities in earlier 2020.

“Demand for inner-city property will remain affected by the closure of the international border as well as ongoing caution on future city lockdowns. This will mean 2021 will remain largely a tenant’s market in the inner cities but will also very much remain a landlord’s market for regional Australia.”