- A Queensland childcare centre has been acquired for circa $12M.

- A consolidated property in Bondi Junction is expecting to go for over $35M.

- A property in the Macedon Ranges has been listed.

Today’s wrap is a broad cross-section of the property market, from childcare to luxury retail, warehouse to farms.

SOLD

Investor secures Queensland childcare centre

Chavel Capital, a Sydney-based Fund Manager, has sold Kallangur’s newest childcare centre to a Queensland-based high-net-worth investor for circa $12 million, representing Queensland’s largest childcare centre sale in recent years.

Located at 100 Cecily Street, the childcare centre opened in June 2023 and is operated by Lead Childcare, which manages 15 centres in Queensland.

The 4,276 sqm site was completed mid 2023 and has the capacity for 206 long day care places, it also includes a swimming pool that is available to all the families attending the centre.

CBRE’s Sandro Peluso, Jimmy Tat, Marcello Caspani-Muto, Michael Hedger and Will Carmen brokered the deal, achieving a 5% yield, on behalf of Chauvel Capital Partners.

ANNOUNCED

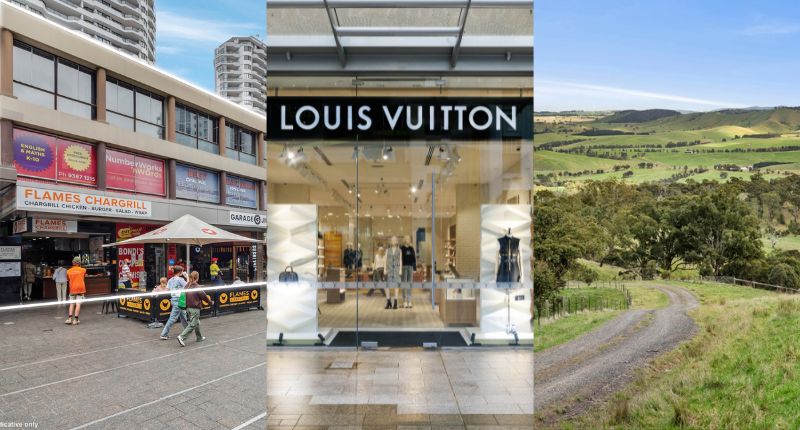

Adelaide CBD to see its first dedicated luxury shopping precinct

The Adelaide Central Plaza, owned by Precision Group, is set for a $125 million upgrade to deliver a new luxury experience.

“There is high demand right now from national and international retailers for prime CBD store locations,” said Precision Group founder, CEO and managing director, Shaun Bonett.

“The demand for flagship outlets is being fuelled by workers returning to the CBD and a resumption of international tourism, as retailers tap into the continued demand for experience-based, physical stores.

“With the benefit of the opportunities that this presents, and the continued strength of luxury retail across the globe, we are reimagining Adelaide Central Plaza through a major new investment, to further elevate the retail experience for customers.

“Along with our luxury group of retailers, we are investing $125 million dollars over the next 3 years to create the first dedicated luxury shopping precinct in Adelaide’s CBD.”

One of the most recognised luxury brands in the world, Louis Vuitton, recently opened a pop-up at Adelaide Central Plaza, joining global luxury and local premium brands in Adelaide’s premier retail district on Rundle Mall.

The Louis Vuitton pop-up is open from 13 October until 28 December.

LEASED

Port Melbourne warehouse facility

Fast Horse Express, a prominent player in the last-mile delivery logistics solutions industry, is expanding its Australian footprint, having leased a state-of-the-art warehouse facility in Port Melbourne.

The successful leasing of 5,630 sqm of warehouse space at 706 Lorimer Street, Port Melbourne, was brokered by Ben Hackworthy from Lemon Baxter, who notes Port Melbourne has become a more sought-after location for the logistics industry.

“Port Melbourne’s importance to logistics companies stems from its strategic location, efficient transport connections, modern infrastructure, and role as a major container port,” he said.

FOR SALE

Consolidated Oxford Mall landholding listed

A consolidated property in Bondi Junction has been listed with the Colliers team of Miron Solomons and Matt Pontey, in conjunction with Andrew Krulis and Michael Burke of Krulis Commercial, with price expectations of over $35 million.

Positioned at the centre of Oxford Mall, with its land area of 1,125 sqm, the properties at 171-181 Oxford Street provide a substantial net income from 37 tenancies.

The site offers over 30 metres of frontage to bustling Oxford Mall and Spring Street.

The expressions of interest close 15 November 2023.

Macedon Ranges landholding comes to market

Colliers’ Agribusiness experts James Beer and Thomas Quinn have exclusively been appointed to bring Lachlan Downs to market – a highly productive 197 hectare landholding in Victoria’s renowned Macedon Ranges, about 50 linear kilometres from Melbourne CBD.

“The property is ideally located just a short distance from Wallan and Melbourne’s CBD (approximately one hour), allowing it to take advantage of Melbourne’s rapidly growing population and booming Northern Growth Corridor,” said Beer.

“The highly productive asset is currently utilised for beef production and is nestled within a region synonymous with high-quality produce across several agricultural commodities, including grazing, cropping, viticulture, and equine.”

The property benefits from improved pastures, quality fencing infrastructure, a gravel laneway system, established shelterbelts, and stock water access in each paddock, as well as a renovated four-bedroom homestead, cottage, multiple machinery sheds, three-stand shearing shed, undercover cattle yards and a back-up diesel generator.

“Lachlan Downs has historically carried approximately 150 breeding cows, with a laneway system connecting all 25 paddocks, providing an average of 600 to 900 bales of hay and silage produced each year, and stock water supplied via storage dams.”

“The property is sown down to various improved pastures, including ryegrass, phalaris, cocksfoot and fescue, with high-quality pasture management and fertiliser application over recent years.”

Lachlan Downs, at 640 Old Mill Road, Bylands, Victoria, is expected to attract interest in excess of $5 million and is being offered for sale by expressions of interest, closing 16 November.