- Acquisition $620M before transaction costs

- Total SGP portfolio will become 7,800 sites

- Move accelerates SGP land lease strategy

Stockland (ASX: SGP) will be acquiring Halcyon Group’s land lease communities business for $620 million.

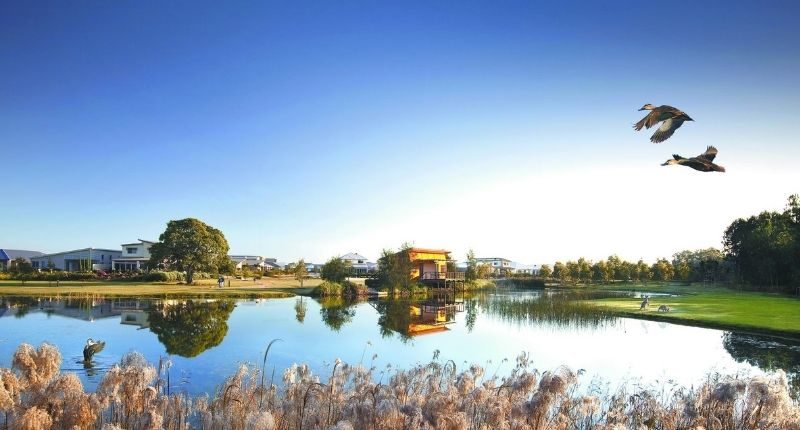

The acquisition will see Stockland take over Halcyon’s 3,800 sites across 13 land lease communities, made up of six established and lease communities, four communities in development and three projects in planning.

Following the acquisition, Stockland will have a portfolio of 7,800 sites, managing director and CEO, Tarun Gupta said there was promise in the sector.

“Land lease communities deliver attractive returns as the demand for high quality, affordable housing solutions grows. This demand is driven by Australia’s aging population and baby boomers reaching retirement age,” said Mr Gupta.

“We see the land lease communities business as complementary to our masterplanned communities land bank and believe there are synergies we can leverage to grow the business at scale nationally and achieve our ambition of becoming a leading operator in this space.”

Tarun Gupta, Stockland managing director and CEO

Stockland will fund the whole acquisition and associated costs from existing liquidity. Paid in two tranches, the company will pay the first one upon completion of the transaction in mid-August 2021, the remainder deferred to July 2022.

Halcyon group managing director, Dr Bevan Geissman, said Halcyon was “really delighted that Stockland recognises the strengths in Halcyon’s brand and capability.”

“Stockland’s diversified property experience, balance sheet, landbank and cultural fit make it the perfect business to lead Halcyon on its next phase of growth,” said Dr Geissman.

Group Executive and CEO Stockland Communities, Andrew Whitson, said the acquisition brings forward the land lease growth plans for Stockland.

“The potential for the land lease business to reshape lifestyle living for the baby boomer demographic is really exciting. As a market, the over-50s are looking for well-designed, personalised housing; security; access to facilities and activities to maintain active lifestyles,” Mr Whitson said.