- Offshore investors returned to Australia in 2022, pumping more than $48 billion into real estate.

- To compete, global brand names have been partnering with local real estate investment managers.

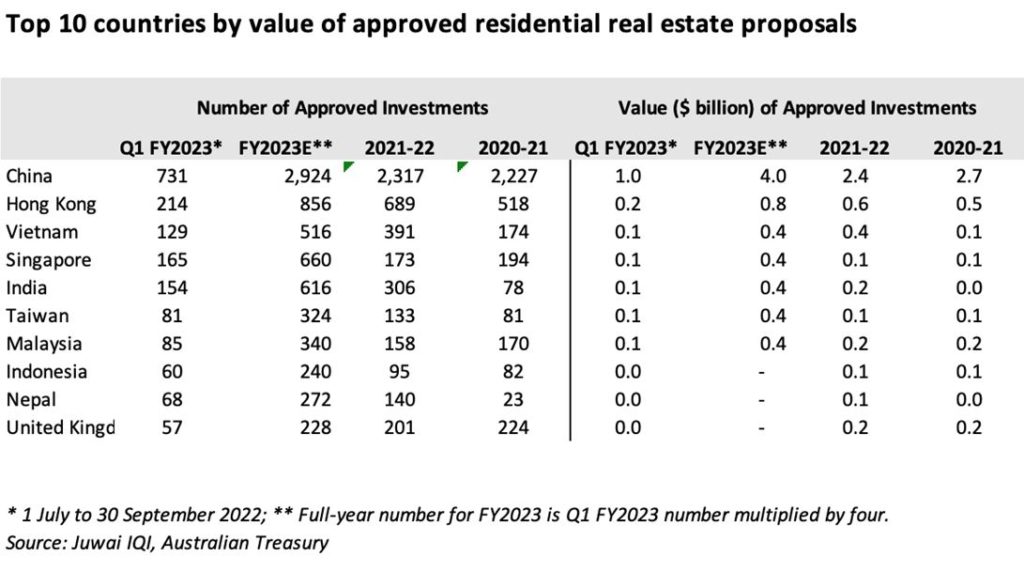

- In 2023 approved Mainland Chinese investment in residential real estate is up by 67%.

With ongoing apprehension around investing into volatile or uncertain markets, a recent trend has shown that offshore investors are benefiting from pairing with an on-the-ground partner to source opportunities in Australia.

There is a growing trend of global firms partnering with local real estate investment managers, including the acquisition of Apollo Global Management of Maxcap, and ADIA investing in Qualitas, observes offshore investment expert Mark Ferguson, a Partner at Australian alternative asset management firm, Jameson TTB.

Ferguson says “Australia remains an important location for diversification and an important piece of global real estate portfolios. The main challenge confronted by offshore investors is Australia’s geography and local competition. Traditionally offshore investors have been slower to mobilise on opportunities taken by better informed domestic investors.

When it comes to cross-border real estate investment, there’s no better way to make an informed call than having a trustworthy, on-the-ground partner” he says.

Heading back down under

After two years of slow real estate investment activity, offshore investors have returned to Australia. In 2022, $48 billion was invested. Even amid continuing global uncertainty in 2023, offshore investors’ demand for Australian real estate remains buoyant.

These buyers are mostly from Asian countries, said Co-Founder and Group Managing Director of Shanghai-based Juwai IQI Daniel Ho.

“The latest Foreign Investment Review Board data reveals that the top five foreign buyer sources by number of transactions are mainland China, Hong Kong, Singapore, India and Vietnam.”

Mainland Chinese by far account for the greatest number of foreign buyer transactions, Ho says.

“The FIRB report covers the first quarter of the financial year 2022-2023, but looking at the annualised numbers, approved mainland Chinese investment in residential real estate is up a dramatic 67 per cent.

“At the first-quarter rate, approved Hong Kong investment in residential real estate is up 33 per cent” he says.

This investor interest is spread but focused mainly in Victoria.

Ho explains: “Victoria received 37 per cent of foreign buying, Queensland 21 per cent, New South Wales 17 per cent, Western Australia eight per cent, the Australian Capital Territory seven per cent, South Australia seven per cent and Tasmania three per cent. The Northern Territory received one per cent.”

“Foreign buyers purchase the full range of property from starter investment apartments to multi-million dollar houses and penthouses,” Ho said.

Increasing investor confidence via an offshore team

Even with travel possible, local representation in Australia remains important to these investors for support through origination, management and exit of investments.

Mark Ferguson said “Offshore investors who fly in and fly out of markets risk missing the best opportunities. By having a local partner, offshore investors can always be leveraging the local network and knowledge, and uncover deals that would otherwise be missed. Often, those who have a local on-the-ground team can make better-informed decisions and ultimately achieve outsized returns.”

Daniel Ho said: “Even experienced foreign buyers are best served by having an agent and lawyer in Australia to assist them in the completion of the transaction. Our excellent teams at IQI WA and IQI Victoria work with many foreign buyers.”

Ferguson says “Our presence in Asia’s World City, Hong Kong, has allowed us to provide all sizes of investors an entry point into the Australian market. We see a lot of large, sophisticated investors in Europe and the US, with a presence in Hong Kong, also keen to allocate money into Australia but are unsure on the best place to start.

“This is one of the main reasons why my Hong Kong-based firm, TTB, has partnered with Melbourne-based Jameson Capital, to form Jameson TTB – to create a direct conduit between motivated global investors and many strong real estate opportunities in a thriving Australian market,” he says.

Mergers and acquisitions trend

Global institutional managers entering the Australian market via M&A activity is a significant trend, present over the past five years, observes Ferguson.

He says “The most notable and recent M&A activity includes Barings (USA) acquiring 100 per cent of Altis Property Partners, Apollo Global Management (USA) acquiring 50 per cent of Maxcap Group, ARA (SG) acquiring a majority stake in LOGOS Group, Growthpoint (RSA) acquiring Fortius Funds Management, and ADIA (UAE) investing in Qualitas.

“We believe this trend will continue as global offshore investors seek a greater slice of the Australian real estate market. The key driver of this trend will be the competition to find the best risk-adjusted returns and deploy capital at scale during a period of limited investment opportunities in the largest market in APAC, China.’

Outside of M&A activity, offshore investors remain committed to both debt and equity investments. There remains significant volatility in equity markets and many institutional investors see debt as a preferred investment for the next 12 months, according to Ferguson.

“On the equity side, there is perennially strong interest in last-mile logistics, industrial, data centres and residential downsizer development. These sectors continuously pop up in the media – spurred by the rapid acceleration during the pandemic” he says.

Offshore investors should be patient

In the current investment cycle, it pays to be patient but opportunistic. We believe the best risk-adjusted returns in real estate will be found by managers who are well capitalised and nimble and who are ready when the right opportunities arise.