- New listings fell -10.4% across the country in July, according to REA

- Sydney saw a -27.3% decline, -26.9% in Adelaide, -14.2% in Melbourne

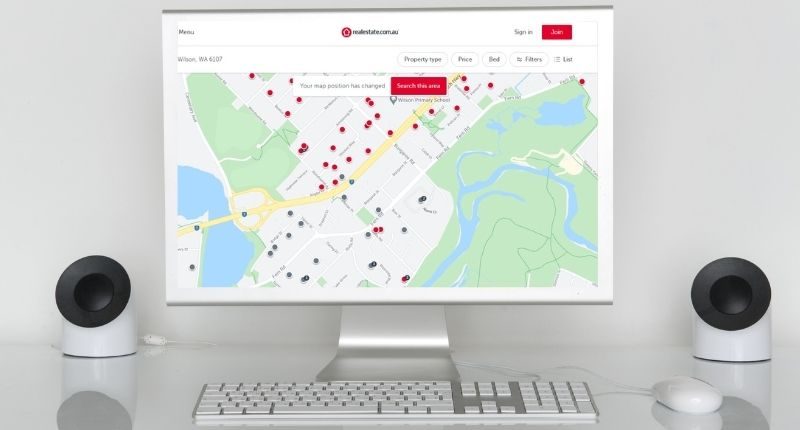

- Online visitors to properties continue to rise, as demand is strong

While half the country continues to be covered by lockdowns, there is less appetite to put a property on the market, according to data from the REA Group.

New listings on the property website fell 10.4% in July. Sydney witnessed a -27.3% decline in new listings followed by -26.9% in Adelaide and -14.2% in Melbourne.

As homeowners opted to delay listing their properties for sale amid the ongoing disruption, buyer demand has remained high with search activity on realestate.com.au up 19% year-on-year.

“This lopsided market dynamic is creating an opportunity for vendors who choose to sell to be able to do so both quickly and at top-end prices,” said Cameron Kusher, Director Economic Research at REA Group.

“While this is good news for sellers, unfortunately for buyers, there is limited choice and fierce competition.”

Mr Kusher noted that while the wave of lockdowns has had an immediate impact on vendor confidence, new listings should rebound again post lockdown. By way of example, listings rose +46.2% rise in Melbourne last year when restrictions were relaxed in October.

Mr Kusher said that one-on-one real estate inspections – which are allowed in New South Wales – had made a meaningful difference.

“While Sydney’s new listings were down in July, if we compare the drop to Melbourne in August 2020, where new listings declined 75.3% over the month, we can see that the Sydney market is still moving, albeit at a slower pace.”

Cameron Kusher, REA Group

Year-on-year, total listings are -23.7% lower, having recorded the largest year-on-year drop in five years. The reason – they are selling, and fast. Even the old ones.

“Properties for sale that were sitting on the market for an extended period of time are now being bought as new supply fails to meet market demand and buyers start to reconsider properties they perhaps once passed over,” added Mr Kusher.

“This trend is especially true in regional markets where there are now fewer properties for sale than in capital cities and supply is at historic low levels.”

Among the top suburbs where listings have shot up include Freshwater in Sydney, Glenroy in Melbourne and Petrie in Brisbane.

Canberra, which wasn’t in lockdown during July, saw new listings jump by +23.3%.

“Demand for properties remains near record-high levels, underpinned by low interest rates and healthy bank liquidity, and continues to dramatically outstrip the supply of stock available for sale.

“Based on the market behaviour following previous lockdowns, we would expect once current lockdowns end, there should be a fairly rapid rebound in the volume of new listings coming to market, seeking to cater to this strong demand,” concluded Mr Kusher.