- Rent gaps reveal areas of strong demand and potential for higher rental income in Australia.

- Investor scores, alongside rent gaps, offer a comprehensive view for investors in property markets.

- WA shines with high investor scores and rent gaps, making it an emerging investment hotspot.

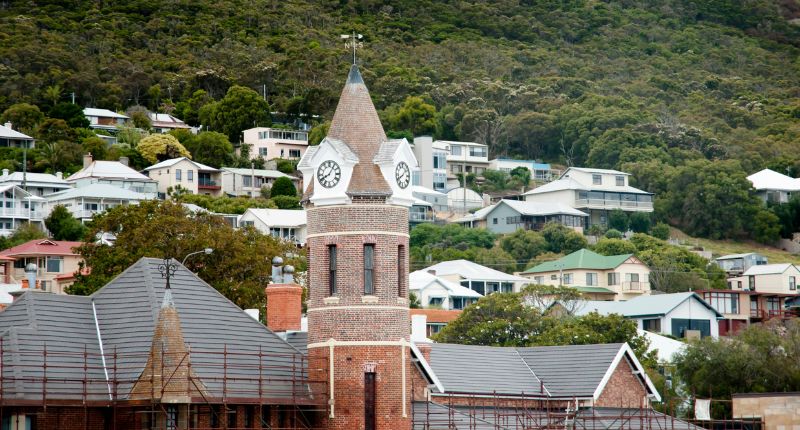

The key to uncovering Australia’s best investment suburbs may lie within rent price gaps, according to a new report published by Henderson Advocacy, a Sydney and Newcastle-based property buyers’ agency.

What are rent gaps?

Rent gaps refer to the percentage difference between the growth of rent prices and property values over one year. A suburb with a rent price gap of 13%, like Parkwood, Western Australia (WA), indicates that rents have increased 13% more than property values of the past 12 months, calculated using the area rental median.

Weekly Rents for 6147, including Parkwood

A noticeable rent gap usually signifies a robust and active market with high demand for rental properties. Put differently, it highlights a supply and demand mismatch in a rental market.

With rental listings continuing to fall short of demand in Australia, the rental market has witnessed a price surge, with property values being outpaced in some markets.

Weekly Rent Listings – National

Hence, areas with pronounced rent price gaps are especially appealing to investors looking to reap a faster and more substantial return on investment through rental income.

“Rent gaps serve as a useful indicator for investors, suggesting areas where rental markets are active, and property investments could show promise,” said Henderson Advocacy founder and director, Jack Henderson.

Investor scores, an added layer of insight

Supplementing the rent gap data is the investor score metric, a composite metric representing investment viability created by Henderson Advocacy that weighs various data points critical to investors and renters, like rental yields, affordability, and area vacancy rates.

The variables contribute to a final score scaled to a maximum of 100.

“The Investor Score provides an additional layer to our analysis, assisting investors in identifying not just areas with potential for immediate rental income but also those that promise long-term capital growth,” Henderson said.

The investor score, together with the rent price gap, gives investors a comprehensive overview of market opportunities, putting a spotlight on suburbs with both significant rent price gaps and high investor scores.

“In Australia’s ever-evolving property market, understanding rent gaps and investor scores is crucial. These metrics can guide investors toward more profitable opportunities.”

Australia’s top 20 investment suburbs

Australia’s top 20 suburbs

| Rank | State | Suburb | Property Type | Rent Price Gap | Investor Score |

|---|---|---|---|---|---|

| 1 | WA (Western Aus) | Parkwood | Unit | 13% | 87 |

| 2 | WA (Western Aus) | Stirling | Unit | 14% | 87 |

| 3 | WA (Western Aus) | Albany | Unit | 11% | 87 |

| 4 | WA (Western Aus) | Mira Mar | Unit | 11% | 85 |

| 5 | QLD (Queensland) | Gordon Park | Unit | 10% | 85 |

| 6 | WA (Western Aus) | Padbury | Unit | 16% | 85 |

| 7 | WA (Western Aus) | Edgewater | Unit | 16% | 85 |

| 8 | WA (Western Aus) | Churchlands | Unit | 14% | 85 |

| 9 | WA (Western Aus) | Ferndale (WA) | Unit | 13% | 84 |

| 10 | QLD (Queensland) | Tennyson (Qld) | Unit | 12% | 84 |

| 11 | WA (Western Aus) | South Yunderup | Unit | 11% | 84 |

| 12 | WA (Western Aus) | Noranda | Unit | 13% | 84 |

| 13 | WA (Western Aus) | Shelley (WA) | Unit | 13% | 84 |

| 14 | WA (Western Aus) | Middleton Beach | Unit | 11% | 84 |

| 15 | VIC (Victoria) | Ringwood North | House | 14% | 84 |

| 16 | WA (Western Aus) | Mullaloo | Unit | 16% | 84 |

| 17 | WA (Western Aus) | Eden Hill | Unit | 13% | 84 |

| 18 | NSW (New South Wales) | Merungle Hill | House | 19% | 84 |

| 19 | WA (Western Aus) | Greenmount (WA) | House | 14% | 84 |

| 20 | WA (Western Aus) | Coolbinia | Unit | 14% | 84 |

Source: Henderson Advocacy.

Western Australia’s suburbs featured prominently in the report’s list of top 20 investment suburbs, shining in terms of their rent gaps and investor scores, with Parkwood, Stirling, and Albany placing within the top three. Notably, WA’s suburbs had consistently high investor scores, averaging around 85.

WA tops the charts for investment opportunities

Other data supported these findings; MCG Quantity Surveyors noted that property investments in WA skyrocketed from a little over 9% to 32% from Q1 2022 and Q1 2023, underscoring the state’s popularity amongst property investors nationwide.

“It’s notable that Western Australia features prominently in the list, positioning the region as an emerging investment hotspot, particularly due to its significant rent gaps,” Henderson commented.

Suburbs from Queensland and Victoria have also appeared on the list, albeit with a relatively subdued presence. Ringwood North was the only suburb in Victoria with a score close to their high-scoring WA counterparts.

Part of this may be attributed to stagnating rental property incomes and a regulatory environment perceived to be hostile to investors, with industry bodies having previously snubbed Victoria’s rental market as the worst in Australia.