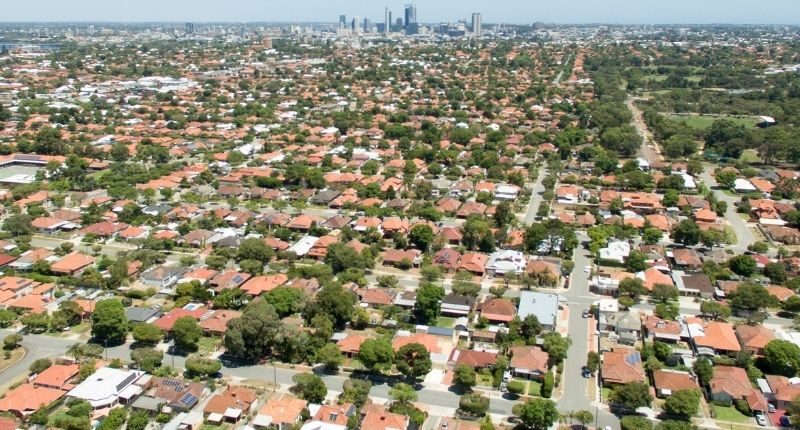

- Booming resources sector to make Perth less vulnerable to housing market downturn, a new report suggests

- The median house price is expected to remain around the same level in 2025

- Units are expected to rise by 3% by 2025

With strong commodity prices and solid investments across the resource sector, it is expected the Perth residential market will perform better than its eastern state counterparts.

During 2021, Perth property prices continued to lift with the median house price surpassing $600,000 for the first time in March 2021 before rising listings lost momentum in the middle of the year.

Throughout 2022, the pace of growth has picked up, despite the national deceleration.

The median house price is estimated to have grown by 10% during 2021/22 to $665,000 as of June 2022.

This resurgence has been assisted by a range of external factors such as the reopening of domestic and international borders, relative affordability of houses, a strong mining sector and a strong jobs market, with unemployment reaching as low as 2.9% in WA during 2022.

SQM Research shows the vacancy rate in Perth is at 0.4% – the lowest since the series began in January 2005.

Greater Perth

[Select part of the chart to zoom in on various years, and ‘reset zoom’ button to return]

On top of this, limited new stock is available thanks to ongoing supply and labour shortages.

What is going to happen to the Perth property market in 2025?

In light of these factors, the median house price in Perth is forecasted to hold over the next two years, therefore outperforming the rest of Australia, according to a QBE report.

The tightening of credit availability is set to weigh on the ability of buyers to bid up prices.

However, the affordability of Perth in relation to elsewhere will help to install a floor under prices.

“The large jump in residential activity has exacerbated capacity constraints. Material costs have lifted, and acute trade labour shortages exist,” the report said.

“This is placing significant pressure on build costs for which Perth is most susceptible.”

Australian Housing Outlook 2022-25 report

A rise in house prices of 4% in 2024/25 is expected to see the median house price reach $679,000 in June 2025.

Perth dwelling prices forecast

Perth Unit Market Outlook 2022-25

The report noted population growth across WA began to recover in 2018 and 2019 – just before the pandemic halted this process.

Now the borders have been reopened for most of the year, WA has now returned to a net overseas migration inflow, which is set to contribute to more population growth.

Strong commodity prices and another round of solid resource sector investments is expected to support average net overseas migration inflow at a level moderately above what was seen before the epidemic.

This significant temporary population that makes up the mining sector workforce are expected to drive the rental market, especially in units.

This is also exacerbated by Perth being reclassified as a regional location for migration purposes. Perth will also benefit from the return of overseas students.

The Perth unit market has remained firm over 2021/22, rising by 3% to $436,000. It looks set to mostly avoid the national downward trends for at least the next year.

“Pressure on housing stock will come from the return of overseas migration, relatively favourable housing affordability and rising resource sector investment.”

Although recent interest rate rises will drag on demand, this is likely to be offset by a sustained dwelling stock deficiency.

The report added that the completion of new train links – the Airport Line opened in October with the Morley-Ellenbrook Line expected to be completed in 2024 – will facilitate the strong tend growth for infill development.

In light of all of this, the median Perth unit price is forecast to reach $459,000 in June 2025.

~~

For other capital cities, check out our Sydney, Melbourne and Brisbane forecast articles.