- Prices have risen in most capital cities, and stock of property has fallen

- Average days on market is also falling, and vendor discount is minimal at around 2%

- All these trends point to a strong property market across the country

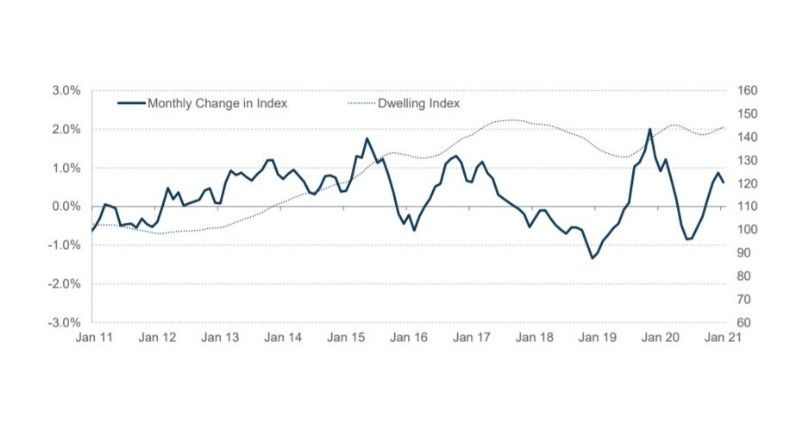

Recent data from CoreLogic from across the country points to a two-year decline in available properties for sale, along with rising prices.

The ‘Daily Home Value Index’ (launched in 2007) is now up to 173 in Sydney as of today, 152 in Melbourne and above water in all capital cities bar Perth, which is at 89.

However, even in Perth, and during a once in a 100 year pandemic remember, the annual rise in home has been +3.8% over the past year. In every other capital city, except Melbourne, prices have risen 2% to 6% since before the pandemic.

While prices are rising, stock is falling.

Over the past two years, the number of total homes for sale across the major capital cities has fallen from a high in February 2019 of 130,000 to around 70,000 today.

Basic economic fundamentals will tell you that as supply falls, so prices rise, given steady – or rising – demand. At the moment, we seem to have all three items in play.

Evidence from the street, with long queues of masked people forming outside a humble 1-bedroom apartment for rent, add to this picture of a rising market, as do the recent auction clearance rates in the high 80% to 90% range.

Less time, less discounting

With a rising property market, you’d expect to see the time on market fall, and less price discounting going on. And that is what we are seeing.

The average days on market is now below 60 days in most capital cities, and a very fast 34 average days in Hobart, and 47 days in Adelaide.

Price discounting by sellers is becoming less common, with the average price reduction from the original offer price hovering around 2% or less. Why chop anything off the price if the market is busy, supply is low and buyers are aplenty?

Everything seems to be pointing to a rising property market, Australia wide.

~~

Before investing in any asset, please do your own independent research, taking into account your own personal financial situation. This article does not purport to provide financial advice. See our Terms of Use.