- The housing market appears to be more balanced between buyers and sellers

- It is likely we are near the terminal cash rate target for this cycle, says Pete Wargent of BuyersBuyers

- Immigration to fuel demand next year

As we enter the last quarter of the 2022 calendar year, the co-founder of the first national property buyer’s agency network in Australia, Pete Wargent of BuyersBuyers, has argued that the Australian housing market is now more balanced between buyers and sellers.

Mr Wargent said that there is no question that the interest rate hikes knocked the housing market earlier in the year.

“That, combined with improved auction clearance rates, indicate that the market is more balanced, especially when it comes to high-quality properties in popular areas,” he said.

“There hasn’t been a tightening cycle of this pace and magnitude since 1994 – when the cash rate target went from 4.75 per cent to 7.50 per cent between July and December – so most young borrowers have never seen anything like this before, and it had a very significant impact on consumer confidence.”

Pete Wargent, BuyersBuyers

“However, the Reserve Bank only hiking 25 basis points this month has had something of a soothing impact on buyer confidence – although there will likely be further hikes to come, it does add to a general feeling that we are getting closer to the terminal cash rate target for this cycle”.

“Peak fear” phase has passed

Mr Wargent added that after months of gloomy headlines, consumers are tired of hearing the same old messages and with the absence of a major property price correction, a lot of buyers are simply moving on and purchasing property.

“At some point you just have to choose to get into the market” he said.

So, what is going to happen to the property market this year and next?

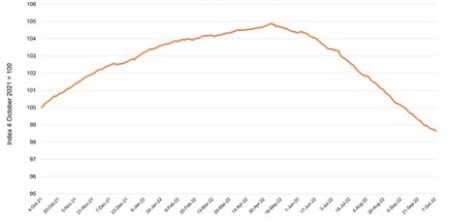

BuyersBuyers CEO Doron Peleg said that capital city prices are now around six percent below their peak, according to CoreLogic’s home value index, and with some further declines expected to occur.

There has been a steady improvement in the auction clearance rate, indicating a more balanced market.

“With Australia experiencing full employment, many prospective vendors can wait out the downturn, given most owners have built up significant equity, have substantial cash buffers, and given that rents are rising by up to 20 per cent per annum,” said Mr Peleg.

“Property market indices tend to lag, because there’s always going to be a delay between offers being made and property sales being settled, recorded, and reported. So price indices will likely show further declines for some time to come yet”

5-Capital City Aggregate

Mr Peleg has said the price declines are likely to become less steep, before being confirmed as bottoming out in the new year.

“CoreLogic reported the highest preliminary auction clearance rate since May this weekend, driven by improving buyer sentiment in Melbourne and Adelaide, as well as less stock flowing on the market.”

Fortnightly % Change in Home Values

“Brisbane’s house prices are seeing some of the speculative excesses wiped away this year, but we’ve also seen unit and townhouse prices rising in many cases.”

“There are still some areas of weakness in Sydney, but stamp duty being scrapped for first homebuyers up to the $1.5 million price point in the new year will likely see a recovery driven from the bottom of the market up,” Mr Peleg said.

New year, new demand

In the lead-up to 2023, Mr Wargent said that immigration may op record highs over the next couple of years, with the annual permanent migration cap being lifted to 195,000.

“The market has been a little segmented recently, but speaking to our buyer’s agent and industry connections in Melbourne shows that well-presented properties are garnering plenty of interest, and even competitive bidding in some cases,” he said.

“The downturn has been driven by a combination of lower borrowing capacity and deeply negative sentiment, but we can expect to see some of the gloomier headlines tailing off now, which leads us to believe that ‘peak fear’ has now passed for this market cycle.”

Mr Wargent noted that with the borders now open and permanent migration ramping up with the return of international students and other temporary visa holders, Australia’s population is expected to increase by 1 million over the next two to three years.

“And this at a time when the statistics are threatening to show builders could be going insolvent at the fastest pace on record, hampering the supply response,” he said.

“Naturally, we do expect lower borrowing capacity to impact some buyer cohorts, including first home buyers, some investors, and particularly upgraders who are really stretching themselves to buy the best home they can. But the doomsday scenarios favoured by some media outlets are looking increasingly unlikely.”

“We’ve passed peak fear,” Mr Wargent said.

‘Interesting behaviour’ among buyers and sellers, says REINSW CEO

Tim McKibbin, chief executive officer of the Real Estate Institute of New South Wales (REINSW), said the compounding impact of rising interest rates on buyers and sellers alike has resulted in “some interesting behaviours”.

“For buyers, the price easing cycle has been playing out for a few months and some people are playing the game of trying to guess the bottom of the cycle. This will only be apparent in hindsight,” he said.

“People who hold off on the purchase of a property they’ve identified as ideal in the hope of paying less down the track will typically end up missing out and settling for less, in a property not as well suited to their needs.

“Supply is low and options are slim. If you find your perfect property then now is the perfect time to buy.

Tim McKibbin, REINSW CEO

“For vendors, many are taking a wait-and-see position as buyer caution prevails amid the broader economic uncertainty.

“Both perspectives are understandable but both are inherently risky. Housing is a nondiscretionary, essential commodity and trying to predict where we’re at in the cycle is fraught with danger.”

Mr McKibbin noted that in a subdued market, it is vital that a proepry purchase should be viewed through a long-term perspective.

“A long-term view is essential when assessing the potential for value growth as well as the typical mortgage duration,” he said.

“Buyers and vendors should be cautious in the current climate, because interest rates are a good chance of rising further and the economy itself is delicately balanced.

“But equally, for those who need to buy, holding off in the hope that prices will continue to fall may prove foolhardy. There are good opportunities available now.”