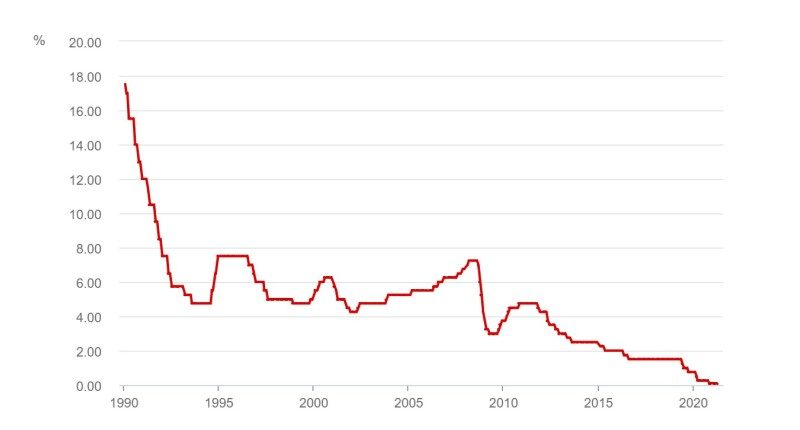

- The RBA dropped the cash rate from 0.75% to 0.1% in 2020

- It has kept the rate at 0.1% since November 2020

- RBA Governor suggested interest rates may not rise until 2024

At its monthly (first Tuesday) meeting today the Reserve Bank of Australia (RBA) decided to keep interest rates at the historically low level of 0.1%.

Low interest rates are one factor feeding into the booming Australian property market, with some commentators suggesting the RBA should do something to slow it down, lest it becomes an out of control, speculative bubble.

However, in a statement, RBA Governor Philip Lowe said while “housing markets had strengthened further, with prices rising in most markets” and that borrowing had “picked up”, especially from first-home buyers, “investor credit growth remains subdued.”

He said that the Bank would be “monitoring trends in housing borrowing carefully” and stated that it is important that “lending standards are maintained.”

Outside the housing market, there were other parts of the economy that had some way to go yet before he might be putting his foot in the brake. In addition, with JobKeeper and other controls now removed, an extra 100,000 to 150,000 people could be looking for employment right now.

“Wage and price pressures are subdued and are expected to remain so for some years,” he said.

“The economy is operating with considerable spare capacity and unemployment is still too high. It will take some time to reduce this spare capacity and for the labour market to be tight enough to generate wage increases that are consistent with achieving the inflation target.”

Dr Philip Lowe, RBA Governor, in statement today

In other words, no need to put interest rates up yet. Dr Lowe wants the economy to roar along for quite a bit longer, especially as we are not yet at full employment, wages are not rising, and inflation is still low.

Indeed, inflation (the rate that prices rise) is expected to stay below 2% for the next few years, he said. Hence, he has suggested interest rates could remain this low for another three years.

“The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.”

Dr Philip Lowe, RBA Governor