- RiskWise Property supports the assertion that units are a risky investment

- Risks include current and expected oversupply, and low external migration

- Houses continue to outperform rental units

Yesterday on The Property Tribune, we reported on research and expert findings that units pose a risky investment compared to houses.

Following on from that article, further findings from RiskWise Property Research look to support the idea that investors should think twice about investing in rental units.

Some property investors likely have the mindset of: while rental asking prices are relatively low, it’s good to pay discounted prices now and enjoy large capital returns when borders are re-opened and external migration drives up demand for rental apartments.

Seems like a reasonable position to have, especially with the rollout of a COVID-19 vaccine and the easing of domestic border restrictions.

However, perhaps investors should be cautious. Taking such improving conditions in isolation may turn out to be a costly mistake.

RiskWise CEO, Doron Peleg warns that there may still be a variety of risks to consider when investing in rental units, particularly in CBD areas.

Oversupply

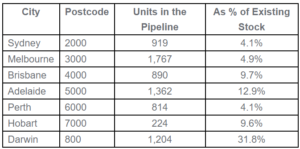

The first short-term risk faced by potential investors is the fact that there has been a relatively high level of supply of rental apartments, both existing stock and in the pipeline. A salient example is Melbourne, which currently has almost 2,000 rental units in the pipeline according to RiskWise figures (see table below).

RiskWise expects that although returning demand for off-the-plan apartment projects could drive up prices, on the other side off-the-plan apartment projects are expecting an increase in supply, offsetting any potential increase in prices.

Potential risks of oversupply have already manifested into reality for some locations, with North-East Perth, Inner Perth, and Inner City Brisbane recording property price declines.

“The opportunity cost of buying an inner-city rental apartment could be high, as houses with similar prices, but in the outer rings or in popular regional areas, are projected to deliver materially stronger capital gains,” said Mr Peleg.

“Put simply, even if a rental apartment does not depreciate or deliver some positive capital growth, effectively, you are still losing, as your wealth could have been substantially higher if you purchased a house in an area that enjoys good demand.”

Low external migration

It is important to note that borders opening and the full easement of international COVID restrictions do not mean external migration will rebound back to its pre-COVID levels.

According to COO and co-founder of BuyersBuyers.com.au, Pete Wargent,

“Reductions in external migration will also have a negative impact on the demand for dwellings, particularly smaller rental apartments.

The Federal government is expecting Net Overseas Migration (NOM) in FY21 to drop to -71,600 people for Australia’s first experience of negative NOM since 1946. This negative trend is forecast to continue in FY22 and only return to pre-COVID levels from FY23 onwards.”

With a stable jobs market being a primary determinant of external migration decisions, poor economic growth and a soft employment market post-COVID will see the attractiveness of relocation to Australia decline in the short-term.

The outperformance of houses over units

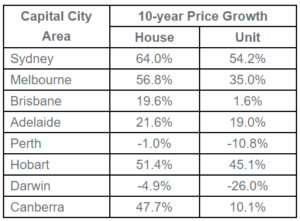

As reported before, house price growth continues to outperform units.

Over the long term, houses have delivered materially higher capital growth and total return (i.e., average capital growth and the average rental yield) than rental apartments, although units in some desirable areas of the mature capital cities have also performed well (see table below).

Land scarcity and undersupply of houses in areas that have good access to major employment hubs, resulted in strong price increases of houses.

Low-interest rates and government stimulus in the form of HomeBuilder grants have also continued to drive housing prices up (see this article).

In addition, houses are generally substantially preferred properties over units.

All in all, expert opinions and recent data look to be sending a clear message: despite improving conditions across the country recovering from the pandemic (particularly borders reopening) rental units still pose risks to investors.

~~

Before investing in any asset, please do your own independent research, taking into account your own personal financial situation. This article does not purport to provide financial advice. See our Terms of Use.