- Occupancies up 3% from FY20, 1% up from half yearly results

- Increased occupancy due to eight new leases and Sydney divestments

- Recent share buy-back of 416,643 securities worth $1.4M

With March well in the rearview mirror, quarterly reports have started rolling in. Previously, The Property Tribune reported on the quarterly reports of The Agency (ASX: AU1), Cedar Woods (ASX: CWP), Acumentis (ASX: ACU), McGrath (ASX: MEA), and GPT Group (ASX: GPT).

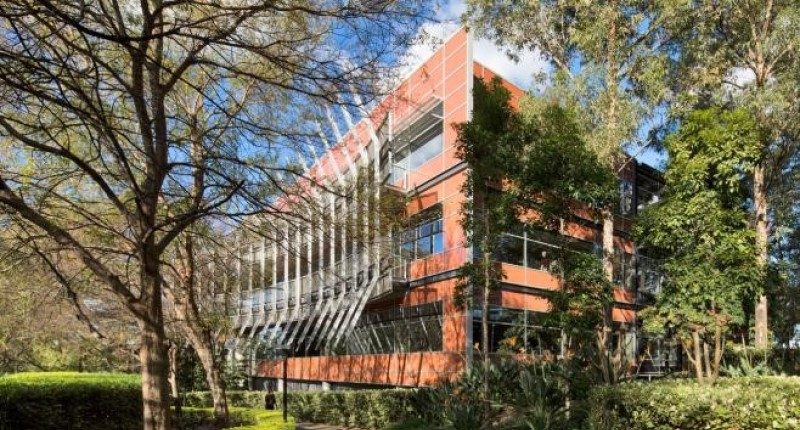

Growthpoint Properties (ASX: GOZ)

Industrial and office property REIT, Growthpoint, is in a strong position, with occupancy rising to 96%.

This figure is 1% up from the half-yearly report, and 3% up from the last financial year.

GOZ said the increase in occupancy was due to the divestment of Quad 2 and 3 in Sydney Olympic Park for $66.1 million “as the properties no longer fit within the Group’s portfolio of defensive assets.” Growthpoint said they remain a significant investor in Sydney Olympic Park though with two assets fully let to Samsung and Lion.

A number of successful leases also helped boost occupancy rates, including eight leases that represented 1.3% of portfolio income. “The weighted average lease term was 7.6 years and the weighted average rent review was 3.1%.”

Australia Post’s 10.5-year lease at Adelaide Airport was the jewel in Growthpoint’s crown, the distribution facility makes Australia Post the company’s eleventh largest tenant which makes up 2% of Group portfolio income.

In detail

Occupancy was up across office, industrial, and portfolio, in the half-year it was 95% across all three, for the quarter it is 96% for office and portfolio, 97% for office.

GOZ said they have a robust balance sheet, gearing well below the company’s target range of 35% to 45%, proforma gearing currently at 29.8%.

The company also had bought back some $1.4 million in securities “in response to market volatility”.