- CBRE recently released their official retail market research report

- There is an expected strong upswing in retail growth for first half of 2021

- One major challenge to retail demand is lower population growth

Recently, The Property Tribune have reported on successes in retail. For example, JB Hi-Fi defied expectations, recording a surge in net profit despite restrictions caused by COVID-19.

Now commercial real estates and services firm, CBRE have released their official research report into the retail market, providing data and insights into how the overall retail market has performed during the unprecedented pandemic.

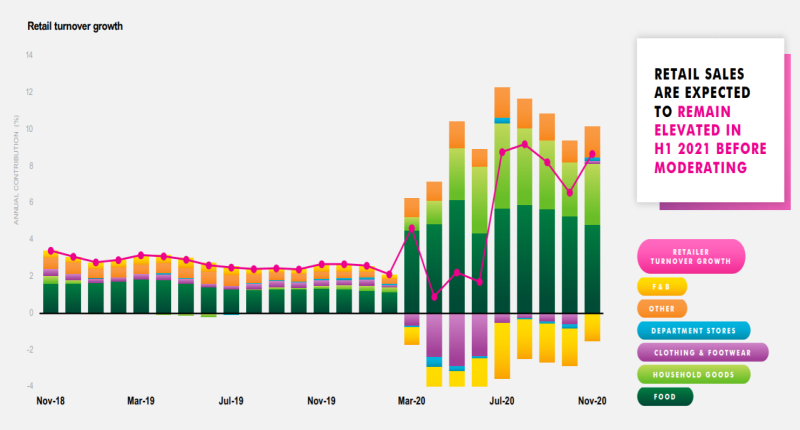

Although 2020 saw retail struggle due to shifting consumer demand, border closures, and trading restrictions, a strong upswing in retail trade growth (particularly increased demand in neighbourhood centres) is expected for the first half of 2021, ultimately offsetting the lost sales of last year.

There was a clear substitution of demand in 2020, with an observed increase in grocery shopping at the expense of cafes, restaurants, and takeaway.

Supermarkets saw record sales, with COVID-19 driving the buying of household goods and food to record highs (this was benefitted by international border closures). For example, supermarkets and shopping centre convenience stores run by ASX-listed company, Charter Hall continued to perform extremely well (covered in this article).

Inevitably, domestic tourism has also seen major growth (which the report expects will continue so long as borders remain closed), with this local spending to offset slowing demand from international visitors.

The report highlights the negative impact that lower population growth will have on retail demand.

Data from Deloitte Access Economics show that population growth will be 480,000 fewer over 2020-22, which will result in 200,000 fewer dwellings required, $11.3 billion lower spending on retail, and 72,000 fewer office workers (the Property Council of Australia has recently also highlighted these impacts, calling on the government to restart net overseas migration in this article).

Supply of CBD, neighbourhood, regional, and strip retail is projected to decrease massively up until 2025, which the report claims will limit the risk of oversupply (exacerbated by slowing population growth). In fact, 40% of new space added for retail purposes will be refurbished in existing centres as opposed to new supply.

~~

CBRE’s full report, Asia Pacific Real Estate Market Outlook: Restart the Uneven Recovery – Retail is available to view online.