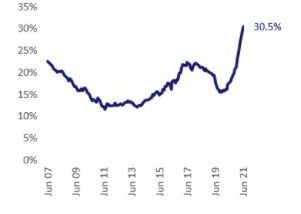

- The gap is the highest on record

- Houses rose by 14.2% over the past 16 months, while units experienced a 5.6% increase

- Canberra has a 74.8% premium between houses and units

A 30.5% gap between median house and unit prices across the capital cities has been recorded – the highest on record, according to CoreLogic.

The demand for detached housing, as opposed to units, has been clear since the pandemic began.

Over the past 16 months, house values rose 14.2% in the capital cities while units only saw a 5.6% increase.

While June 2021 records the biggest gap for Sydney, Melbourne, Brisbane, Adelaide and Canberra, Perth’s price gap declined slightly – but from a record high of 39.1% during May to 38.9% in July. In Hobart and Darwin, the price gap has been trending downwards.

Sydneysiders wishing to trade a unit for a house will have to fork out a significant premium – the gap is currently 54.2%. Unit values have been declining thanks to low levels of investor participation and less interest in unit stock due to subdued rental conditions.

Melborunaians have the same fate with a 52.4% gap, thanks in part to the weakest rental market performance since the pandemic began which exacerbated the weak market from the preceding years.

Throughout 2017 and 2018, house price premium over units averaged 46.3% due to high unit supply and the development of high-density stock which kept unit prices relatively low. CoreLogic argues this trend may change due to a decline in the number of new units being constructed with a rise in the construction of new houses.

Combined capital cities price gap

In Brisbane, the gap is 58.2% which has been fairly consistent since mid-2015, while Adelaide has accelerated to 53.5% due to elected levels of unit construction since mid-2017.

The city with the largest gap is Canberra, at 74.8% – significantly more than double the capital city average. For the 10 years to March 2021, 5.5 units were supplied to the market for roughly each house construction. Nationally, this was two units per house over the decade.

Canberra price gap

CoreLogic’s head of research, Eliza Owen, noted factors contributing to this gap included subdued property investment levels last year – investors tend to purchase units over houses – along with HomeBuilder targeted at those building houses and the attractiveness of lower density living.

However, she suggested this could change.

“… as gradually higher levels of vaccination pave the way for safer high-density living, and affordability constraints are reached in detached housing, there may be more demand for unit stock in the years ahead, which would narrow the value gap between the two stock types.”