- Kevin Barnard fraudulently obtained $147,763 in GST refunds

- Claimed to be building a high-rise apartment at Broadbeach

- ATO Assistant Commissioner labelled the act as "blatant fraud"

A Gold Coast property developer has been sentenced for fraudulently obtaining $147,763 in GST refunds for a development he claimed to be building when he had never owned the land nor obtained finance nor submitted any development applications.

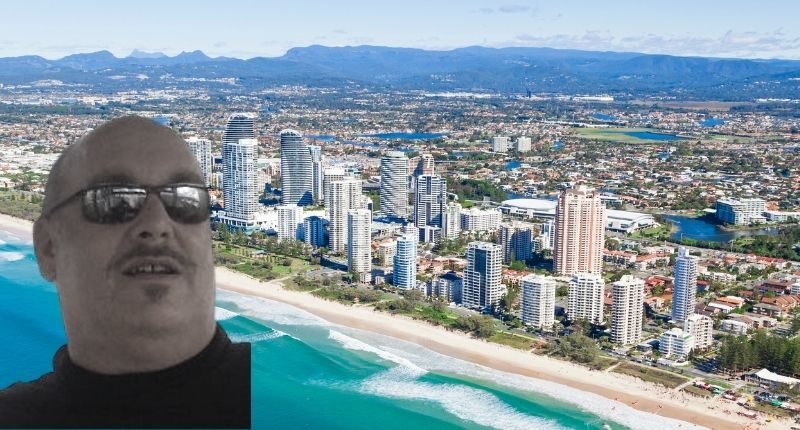

Kevin Barnard, in his capacity as director of Share Water Developments Pty Ltd, claimed to be constructing a high-rise apartment at Broadbeach, a suburb on the Gold Coast.

He had lodged eight business activity statements with false expenses concerning the development. Once the Australian Tax Office (ATO) conducted an audit, it found that he had never owned the land in Broadbeach, hadn’t obtained finance for the project and had not submitted any development applications for the site.

None of the expenses claimed in the lodgements had been incurred.

Mr Barnard also attempted to obtain an additional $76,253 in fraudulent refunds before this was stopped by the ATO.

Ian Read, Assistant Commissioner ATO, said the kind of deception employed by Mr Barnard was a case of effectively stealing from taxpayers.

“We have no tolerance for blatant fraud like we have seen in this case,” Mr Read said.

“In this instance, the defendant won’t serve his sentence due to a medical condition, however, this is an exception. Those who are deliberately trying to cheat the tax system can expect to get caught and face large fines and even jail time.”

Ian Read, ATO Assistant Commissioner

“Tax fraud is not a victimless crime – those who engage in this criminal behaviour are obtaining an unfair advantage over those who do the right thing.”

Mr Barnard was sentenced to three years imprisonment but released on a recognisance release order, and a three-year good behaviour bond of $5,000.

He was also ordered to pay back the full amount to the ATO.

His Honour Rowan J said he released the defendant as he was not satisfied with Mr Barnard’s medical condition could be adequately managed in custody.