- Homelessness is a pressing issue compounded by underinsurance

- Natural disasters are elevating homelessness in Australia

- There are steps property owners can take to prevent the impacts of homelessness

I had an enlightening discussion with my business partner Marty Sadlier over the holiday’s that’s brought into sharp focus a problem requiring urgent attention, so I invited him to post his thoughts.

What follows is Marty’s views on this dire situation.

I’ve been looking at a link between one of the most pressing social issues of our day, and the way it impacts the broader community’s financial security.

That issue is homelessness and its interrelationship with property underinsurance. Both homelessness and underinsurance result in greater risks and higher premiums for everyone holding a policy. Unfortunately, the situation has been compounded in recent years by a spate of natural disasters.

The loss of housing supply

The aftermath of a natural disaster is not just massive cleanups and remediation. The sudden, and at times vast, loss of property also results in soaring construction costs and increased rents.

Given the fallout from floods over the last three years due to La Nina, extensive amounts of property are no longer available for habitation by either renters or homeowners. In addition to this loss of residential stock, flooding can see many commercial operations brought to a standstill, which impacts worker incomes and economy-boosting production.

All these factors have built upon recent supply chain and pandemic-led construction cost challenges too.

The fallout has been building material delays, labour shortages and extended construction programs.

Many construction firms have shut their doors in recent times as well. Rising costs have squeezed margins – particularly for those builders who signed fixed-price contracts before materials cost escalations. With profitability eroded away, multiple construction companies have had to tighten their belts or walk away from operations altogether.

The consequence of there being fewer builders is ultimately a lack of competition. That means less options for those seeking contractors to complete insurance repairs or rebuilds at reasonable prices and within sensible time frames.

The result is a lose-lose for stakeholders across the board with the number of displaced residents mounting all while construction programs stall.

These outcomes are contributing to a mounting homelessness crisis across Australia.

The extent of homelessness

Homelessness is pressing issue with no near-term solution. On any given night, 1 in 200 people are homeless.

The key drivers of homelessness include domestic violence, the high costs of housing, the inadequacy and inappropriateness of existing housing stock, and the discharge of people from institutions who do not have safe, stable, affordable homes to go home to. Add in the rising cost of construction affecting those with inadequate insurance coverage and you can see the potential for the situation to worsen.

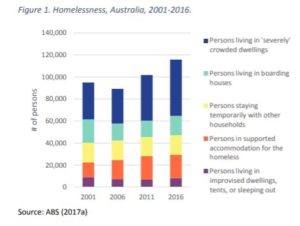

ABS Census data describes the many various forms of homelessness in Australia which include:

- Persons living in ‘severely’ crowded dwellings,

- Persons living in boarding houses,

- Persons staying temporarily with other households,

- Persons in supported accommodation for the homeless,

- Persons living in improvised dwellings, tents, or sleeping out.

All these categories are connected and intertwined with the high levels of underinsurance in Australia. If property owners are unable to rebuild in a timely manner, or unable to rebuild to the same standard (or at all due) to underinsurance, it means more people are falling into homelessness within these categories.

The stark reality is that many rental properties are also been destroyed by natural disasters. There is already a tremendous lack of supply and record demand for rental properties in this country. When you add in demand for emergency housing after a disaster, there the problem is amplified.

Make no mistake – housing is a human right. It’s fundamental to people’s present lives and future plans. When housing is safe, affordable, and appropriate, it delivers security and a sense of connection. Accessible housing is a strong predictor for many positive social outcomes.

Finding solutions

While I don’t profess to have all the answers to the homelessness issue in Australia, one thing appears obvious to me. If we address underinsurance, it will go some way toward alleviating the stresses around housing our citizens.

I suggest a few things every property owner should do.

Firstly, ensure you are regularly updating your insurance policies and insurance value. Construction cost increases and building time blowouts are still occurring, so make certain you are fully covered under today’s parameters. Having an accurate, up to date assessment will help smooth the path back into your home. Also, double checking your policy’s terms on emergency and ongoing accommodation will bring peace of mind.

Next, utilise the skills of a specialist quantity surveyor in assessing your insurance value. Online calculators are notoriously inaccurate when it comes to assessing value. Even skilled professionals such as property valuers are not qualified to deliver accurate insurance valuations. This is firmly within the domain of a quantity surveyor, so don’t short cut the process by relying on a substandard method of insurance value assessment.

Finally, have contingency plans in place. Know that if you lose your home due to unfortunate circumstances beyond your control, there is somewhere you can go that will provide shelter for you and your family as you work through the remediation process.