- More women own property, but men lead in sole ownership.

- Young women face lower homeownership rates due to income and employment disparities.

- Men are more likely to own investment properties, highlighting financial education gaps.

More women own property than men, according to a new report released by CoreLogic.

The CoreLogic 2024 Women & Property report surveyed homeownership status, motivations, barriers, and attitudes regarding homeownership among women and men.

Share of dwelling ownership (by gender)

It found that 68.2% of women in Australia owned at least one property, compared to the marginally lower 67.4% of men.

Sole ownership more prevalent among men

Interestingly, women were more likely to own a home with another person, at 53.3%, compared to 51.9% for men. Men were more likely to be sole owners, at 51.9%, compared to 50.2% for women.

CoreLogic head of research and report author Eliza Owen said the survey used a fresh methodology, allowing for more in-depth insights into the subtleties of homeownership.

“Examining home ownership holistically unveils gender equity gaps, highlights generational risks, and underscores the critical role of residential real estate in wealth, retirement, and tenure stability,” she said.

“It prompts crucial questions about the accessibility of property ownership for women across generations and the challenges faced for early entry into the market.”

Eliza Owen, CoreLogic

Generational differences in homeownership

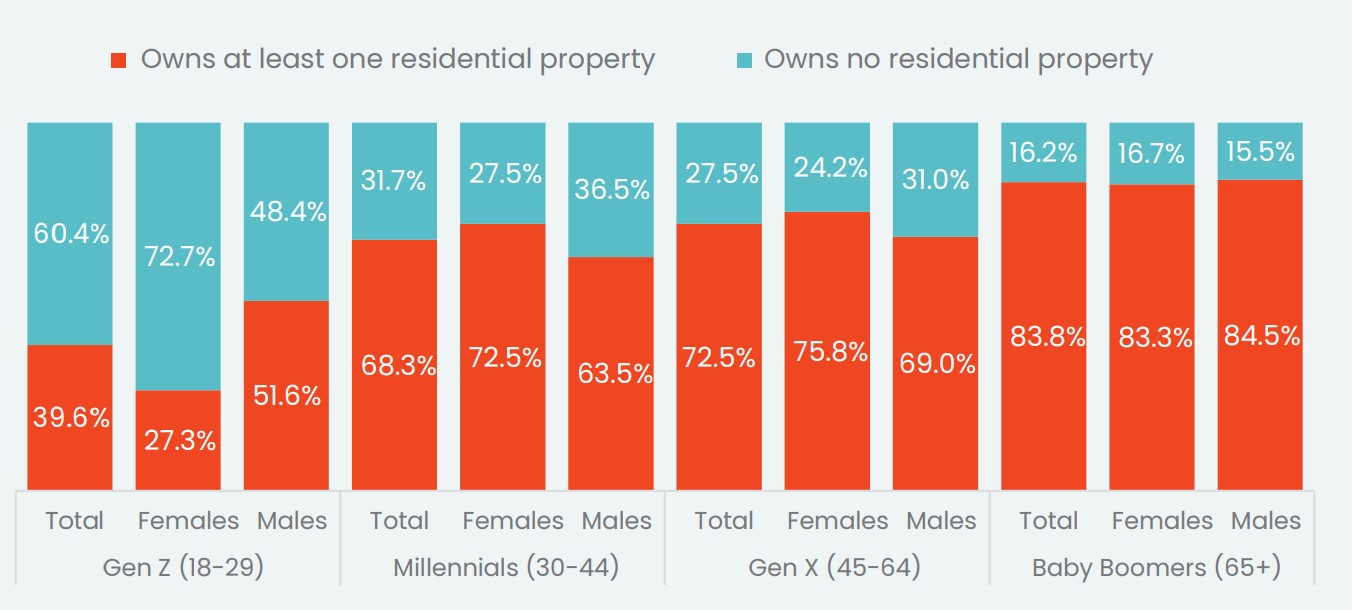

The survey uncovered a substantial divide in homeownership between women and men ages 18 to 29, also known as Gen Z. While 51.6% of men in this age group owned at least one home, women owned 27.3%.

This was partly explained by Gen Z women’s generally lower average income levels, at $67,823 compared to $83,468 for men, and were almost three times as likely to be employed part-time or casually, at 32.9% compared to 12.9%.

Residential property ownership by gender, age

These differences levelled out with age. For millennials, women owning at least one dwelling rose to 72.5% compared to 63.5% of men. For Gen X, it was 75.8% of women compared to 63.5% of men.

Baby boomers had the highest homeownership rate, with 83.3% of women and 84.5% of men owning property.

Owen remarked that, given the significance of residential real estate, it was an encouraging sign to see homeownership rates between the sexes stabilise over time.

Nevertheless, she said the research provokes questions over homeownership timing, as well as barriers to home buying.

“Presumably the gender-based home ownership gap closes in part due to the formation of couples and family households, so while the pay gap between men and women becomes less important for mixed-gender couples, it may pose potential risks during relationship breakdowns,” she said.

“Further, if men can attain dwelling ownership at a younger age, they are likely to benefit from greater levels of capital growth from the asset class over the long term.”

Men more likely to own property investments

Residential investments favoured men, with 14.1% reportedly owning at least one investment property compared to 12.5% of women.

Owen noted that this pattern was present through most asset classes, with asset shares having the largest disparity of 12 percentage points.

Reported investments by gender

“This gap may be tied to differences in income between men and women, but it may also reflect differences in exposure to financial concepts through education.”

“Greater intervention at the high school and university level to familiarise young females with concepts of economics, finance and investment may help to bridge the investment gap, not just across property, but a range of asset classes.”

More can be done to improve homeownership for younger women

Homes account for 56.7% of household wealth nationwide, offering wealth, security, and a path to retirement.

Though the findings show similarities in the homeownership between men and women, there were some disparities, and more should be done to help women achieve the Australian dream.

“Accessibility to home ownership varies, with younger, low-income households experiencing a prominent decline, and gender-related challenges persisting, exacerbated by the gender wage gap,” Owen said.

“Despite overall dwelling ownership parity, this year’s survey reveals that affordability constraints and the home-buying process pose significant challenges for a higher share of females, emphasising the need for targeted solutions to address gender disparities in Australian home ownership.”