- Rental vacancies in Sydney fell 0.2% in June

- Sydney's inner ring vacancies rose to to 4%

- Vacancies in many regional areas remain at historical lows

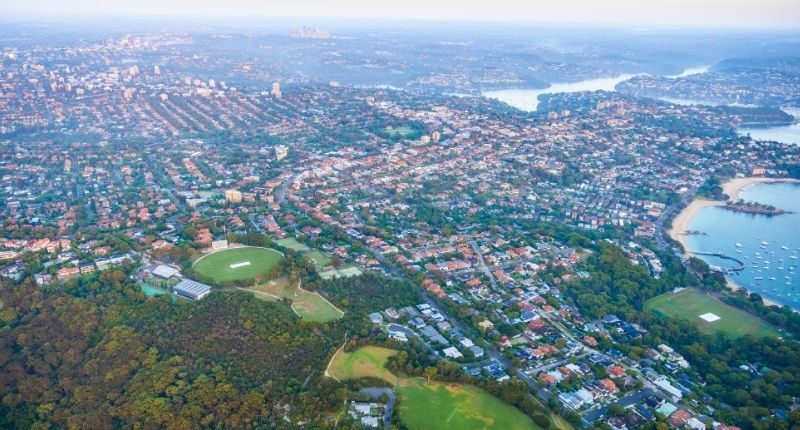

The Real Estate Institute of New South Wales (REINSW) has released its vacancy rate survey results for June 2021 which show that residential rental vacancies in Sydney have declined for the second month.

The rate fell by 0.2%, after falling by 1% the previous month, taking the vacancy rate to 3.1%.

“There’s no doubt that the Sydney residential rental market has been significantly disrupted by the Covid pandemic, however, the tightening of the rate signals some signs of people moving back closer to the city,” said REINSW CEO Tim McKibbin.

“Additionally, returning ex-pats are also contributing to the increased demand.”

Tim McKibbin, REINSW CEO

Mr McKibbin explained that the drop can be attributed to lower vacancy rates in the middle and outer rings of Sydney.

The middle ring saw vacancies at 3.2%, a 1.4% decline, the lowest since March 2019. In the outer ring, vacancies tightened to 2.2%, a 0.3% fall.

The inner ring, however, witnessed an increase of 0.7% to 4%. This was despite the rate falling last month.

Sydney, since 2010

[Select part of the chart to zoom in on various years, and ‘reset zoom’ button to return]

Although SQM Research data is yet to update their data for June (at the time of writing), since May 2020 residential vacancy rates in Sydney have declined most months.

Outside metropolitan Sydney, Newcastle’s rates remained stable at 1.6% while Wollongong saw a slight increase to 4%.

For much of regional New South Wales, rates remain at historically low levels. Albury, Central Coast, South Coast and South-Eastern regions all saw their rates drop in June.

“Feedback from our members in these areas indicates that stock is extremely tight, as tenants continue to exit the major metropolitan markets to secure a property that suits both their budget and desired lifestyle.”