- Ms Pham has over 20 years of experience in the industry, first entering the world of property at Paladin

- She first learnt the value of high conviction strategies at Folkestone, bringing these learnings to her latest role at Pengana Capital

- Has always been a believer in ESG's, which she says is Pengana's main point of difference from competitors

In our latest installment of Real Story, The Property Tribune spoke to Amy Pham, Fund Manager at Pengana Capital.

Ms Pham has over two decades of experience in funds management, with a particular focus on high conviction strategies and building ESG-focused portfolios.

Joining Pengana Capital in 2020, Ms Pham now plays an integral role in Pengana’s High Conviction Property Securities Fund contributing to the Group’s mission to encourage responsible investment.

A fascination for information flow

University was always the first choice for Ms Pham, studying economics at the University of New England in the early 90s, and even embarking on an exchange program to the University of California in the United States.

“Coming across to Australia as a young refugee, university was a privilege and something that I really wanted to take advantage of, and economics was a really interesting blend of the theoretical and practical which I knew could offer a variety of paths after graduation,” she said.

Ms Pham began her professional career shortly after graduating, earning her first role as a quantitative analyst at British multinational financial services company Legal & General.

It was during her time there that the world of investment caught her eye, and she put herself forward for a role as an equity analyst at Perpetual.

“I looked at the information the equity guys had at their disposal and the way they were using it in their investment decisions, so I applied for a role there and I got the role,” said Ms Pham.

However, it wasn’t until 1998 when Ms Pham joined Paladin managing property securities, where she says her property career really began.

“The information flow in the property sector is amazing, it’s a surprisingly deep sector in terms of the companies that fit under it, and the sector always finds new ways to reinvent itself” she explained.

High conviction does not equal high risk

By 2014, Ms Pham had joined Folkestone as a Portfolio Manager, which is where she first delved into managing funds with a high conviction strategy.

“We ran that strategy for about 5 or 6 years and towards the end of it Charter Hall took over Folkestone, and I came across to Charter Hall,” she said.

In her years at Folkestone and Charter Hall, Ms Pham came to learn the value of a high conviction approach, particularly in a property sector that is highly concentrated with the top eight stocks making more than 80% of the index, and is heavily weighted towards the retail sector.

“In order to really outperform you’ve got to be high conviction.”

A firm believer that a high conviction strategy is the best way to add value, Ms Pham says the approach is often misunderstood.

“People think high conviction means high risk, but it’s actually not true. Our track records show that we are able to actually have higher returns but lower risk in the market.

“This is achieved by investing into new growth sectors such as childcare, retirement living, healthcare and digital information,” she explained.

Investing responsibly with an ESG focus

After years of experience managing high conviction portfolios, Ms Pham saw a gap in the market for a listed property fund with an ESG focus.

“Building a fund from scratch was something I always wanted to do, and so I pitched the idea to Pengana.”

Ms Pham joined funds management company Pengana Capital in 2020, attracted to the other similar high conviction strategies on offer and company-wide attention to ESG factors.

“They are very big on ESG and that’s what the fund is about, high conviction with an ESG focus. I think that the ESG component is what really differentiates us from our competitors.”

She added that she has always been a believer in ESG’s, saying that it provides a much better risk return profile of your investment and stronger long-term earnings..

“Take an asset that has got a high NABERS rating for example, it attracts better tenants because the running cost of being a tenant in that building is a lot lower than one that has a low NABERS rating.

“It attracts better tenants that tend to stay longer and you have a higher occupancy rate. It actually contributes to a more sustainable earning profile for you.”

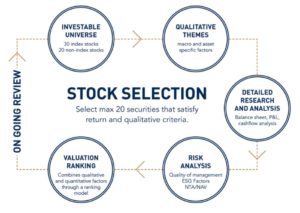

Pengana takes an innovative approach to creating its funds, conducting its own research inhouse to bridge the gap of information for investors.

To achieve this, Pengana generates questionnaires for the companies they invest in and use the responses to rank each in terms of the ESG goals, creating conversations that can provide an insight into each company.

“For us, our point of difference is being high conviction. We are the only property securities fund that actually incorporates ESG directly into our evaluation of companies.

“We do a lot of our research ourselves. We don’t use a third party to do the work for us. We’re very big on providing capital security, income yield and sustainable earnings growth, that’s what we really focus on,” Ms Pham concluded.