- Lasseters International Holdings sold the Hotel Casino to Iris Capital for $105M

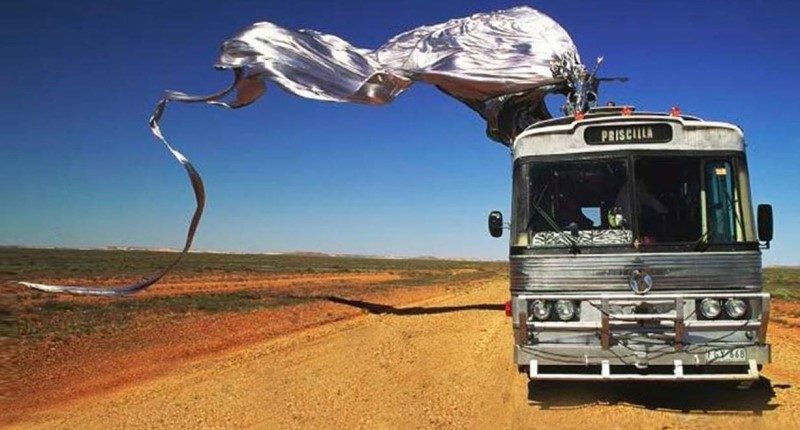

- Featured in the 1994 Australian film 'The Adventures of Priscilla, Queen of the Desert'

- Company spent $50M on refurbishments over the past eight years

Lasseters International Holdings, a Singapore-listed group, has announced the sale of its Hotel Casino on Alice Springs to Iris Capital. The group has owned the Northern Territory Casino for 24 tears. The deal is reportedly worth $105 million.

Originally known as the Diamond Springs Casino, the venue opened in 1981 and has since been an integral part of the Central Australian tourism industry.

Most notably, the Hotel Casino was in the classic 1994 film The Adventures of Priscilla, Queen of the Desert. In fact, the plot of the movie centres around Anthony “Tick” Belrose, under the pseudonym of Mitzi Del Bra, accepting an offer to perform his drag act at Lasseters Hotel Casino by his estranged wife Marion, who lives in Alice Springs.

When Lasseters purchased the property in 1997, features then included a 75-room hotel, 188 gaming machines, 21 table games and several dining facilities.

Over $50 million has been spent on renovation over the past eight years with the Hotel Casino now boasting a 4.5-star hotel with 205 rooms – 130 more than when the property was acquired – and now operate under a franchise with InterContinental Hotel Group (IHG) – ‘a fine romance’.

Additionally, the property has a fully equipped commercial health club, a day spa, the Alice Springs Convention Centre. For those who ‘love the nightlife’, multiple bars, restaurants, and an international standard casino with 320 electronic gaming machines, are also on the property. ‘Mamma Mia’.

Sydney-based Iris Capital, which was established in 1995, currently has over 2,000 apartments, three vineyards and 25 hotels already under its portfolio.

In a statement to the Singapore Stock Exchange, the group said the sale provides a good opportunity to unlock the value of their portfolio’s assets. The group added it wishes to focus on its investments in Malaysia. Hopefully, ‘they will survive’.

“It has been a pleasure having such a unique and diverse property on our portfolio. Lasseter’s greatest asset is the dedication and commitment of the staff, some of whom have been with the company in excess of 20 years.

“On behalf of the board, we wish them the very best in this next chapter and express our most sincere gratitude to each and every Lasseter’s employee who has been part of this most remarkable journey.”

Datuk Paul Wong J.P, Lasseters CEO

Also acknowledged was the “highly regulated” gaming sector in Australia, which has been in the spotlight recently due to ongoing issues with the key player, Crown Resorts.